By accessing the module ”Benchmarking studies” from our TPSoft database you will find essential information for conducting a benchmarking study (comparability) which is an important part of the transfer pricing file and transfer pricing policies. In no time at all you can see the profit margins for different types of transactions in any industry. This is how you will be able to know how to procede and make sure your transactions are “arm’s length”, as the law requires!

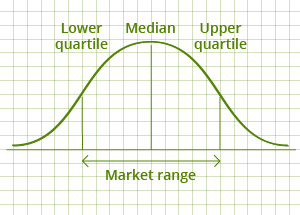

The interface allows you to use various search criteria (eg. NACE code, independence / affiliation, number of employees, turnover, companies recording losses, time/period analyzed) and automatically calculates the median and inter-quartile range depending on the analyzed period of time and the desired profitability indicator (2008, 2009, 2010, 2011, 2012, 2013 and three or five years period in case of multiple analysis per year).

Profitability indicators used when calculating inter-quartile range:

- full cost markup;

- return on sales;

- gross margin;

- return on assets.

Using the database allows you to extract selected data in an excel format so the user can calculate other indicators.

To test the new TPSoft database, please submit your message mentioning “TPSoft credit".

for transfer pricing safety

for transfer pricing safety