In Romania, taxpayers should document compliance with arm’s length principle surrounding transfer prices charged in inter-company transactions. Therefore, they must prepare a transfer pricing documentation file subject to the terms and conditions (find here). Failure to present the transfer pricing documentation file means fines: from 12,000 RON to 14,000 RON for companies falling within the category of medium and large taxpayers; and from 2,000 RON to 3,500 RON for the other companies and for the individuals.

But, more than fines and penalties, the real issue is the THE ADJUSTMENT: if tax authorities consider that the prices applied in related-party transactions differ from prices that would be agreed between unrelated entities (do not meet the arm’s length standard), then they may adjust tax base, with important implications on your business:

Cashflow / Predictability: the company uses the money they have today to pay contingent spending from the past (retrospective payments, penalties, income tax). If the company does not have profit, reduction of losses (reduction resulting from the adjustments) translates into smaller amounts of earnings to be deducted during the next years.

There are also situations when transfer prices for goods subject to customs duties were not determined using a method that is accepted by the customs authorities. This being the case, the importer will have to pay additional customs duties as well as any interest or resulting penalties.

Development plans: with fewer resources available the company must postpone or rethink their investment plans.

Performance indicators: adjustments of performance indicators (especially regarding profitability) will affect the image of the company on the stock market (for listed companies) and increae the cost of financing costs required by banks / investors.

Business of the entire group: these transfer pricing adjustments can trigger double taxation (taxation of the same profits on both sides of the transaction). The group should seek an amicable settlement in order to avoid double taxation (on long term, additional costs) and / or an arbitration agreement. At the same time, the group (parent company) must review the transfer pricing policy in relation to all subsidiaries.

Rewards for those who have a good understanding of transfer pricing implications...

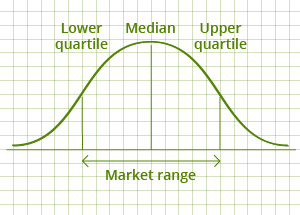

Taking a proactive attitude towards transfer pricing (i.e. analyze the intercompany transactions, setting a transfer pricing policy and prepare a solid transfer pricing documentation) could bring major benefits to a business in terms of fiscal protection by ensuring a defendable position in case of a tax audit. Your rule of action should be a consistent transfer pricing policy!

for transfer pricing safety

for transfer pricing safety