Transfer pricing methods are analytical tools designed to determine the arm’s length nature of transfer prices for transactions between related parties. Multinational companies use these methods as a tax planning tool. Tax authorities use these methods to test the market value of transactions between related parties in order to determine the "real profits", i.e. profits that would have been obtained if the two parties were not related.

The main purpose of this section is to describe the transfer pricing methods established by Romanian legislation as well as practical considerations to be taken into account by the taxpayer when choosing a particular method.

Domestic legislation presents five transfer pricing methods generally in accordance with the OECD Transfer Pricing Guidelines. These are divided into two main categories. i) traditional methods, and (ii) transactional profit methods. The first category consists of: the comparable uncontrolled price method (“CUP” method), cost plus method and resale price method. The second category consists of: the transactional net margin method (“TNMM”) and the transactional profit split method.

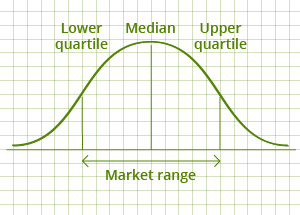

for transfer pricing safety

for transfer pricing safety