TRUST

PRACTICAL

- Apple+Ireland vs. Brussels: the iCase of transfer pricing seen through 13 +1 recitals 2020.07.22

- TPS turns 11! Thank you for your trust 2020.03.06

- The very first DAC6-Partner workshop: interactive and instructive! 2020.02.05

- Melting Greenland and the obscure side of the Trump vs. Denmark scandal. A tax perspective! 2019.08.23

- Knowns and unknowns about the nearing transposition of DAC6 (the ”over transparency of intermediaries”) Directive 2019.08.06

- The fiscal battle vowed to be won by Mrs. Ursula von der Leyen, the new EU top executive (with no fanaticism hopefully)! 2019.07.16

- TPSkit (II) - PREXIT 2019.06.06

SOLUTIONS

YOUR QUESTION HAS AN ANSWER FROM TPS

Home

This section includes a list of the most frequently asked questions on transfer pricing

1. What qualifies two companies as related from a transfer pricing perspective?

The threshold for related party is mainly defined by 25% direct or indirect ownership as well as by 25% of the voting rights in the management bodies of a company. In addition, a person related to the taxpayer shall be any non-resident legal entity from the jurisdiction of a preferential tax system with which the taxpayer carried out transactions.

2. Will transfer pricing audit be carried out as part of the general tax audit or as a separate audit?

Currently, we are expecting both scenarios. So far, the transfer pricing audits were carried out as part of the general tax audit. With the introduction of the Transfer Pricing Rulebook, we expect separate tax audit for the transfer pricing to be performed.

3. Are there specialized teams of inspectors for carrying out transfer pricing audits?

Yes. Currently, there is an ongoing process of training tax inspectors in the area of transfer pricing.

4. Which companies are more likely to be audit by the tax authorities?

Considering the developments in the other countries, the companies who recorded ongoing losses or fluctuating profitability during the last years are more likely to be audited by the tax authorities.

5. What are the applicable transfer pricing methods?

In determining the price of an intra-group transaction in accordance with the arm’s length principle, the following methods are used:

- comparable uncontrolled price method;

- cost plus method;

- resale price method;

- transactional net margin method;

- profit split method;

- any other method which makes possible to determine the price of a transaction in accordance with the arm’s length principle, provided that the application of the aforementioned methods is not possible or this other method is more appropriate to the circumstances of the case compared with aforementioned methods.

6. Is there any formal priority in using the transfer pricing methods?

There is no formal priority for using the transfer pricing methods. The method that best correspond to the circumstances of the case should be used.

7. How do tax authorities make transfer pricing adjustments?

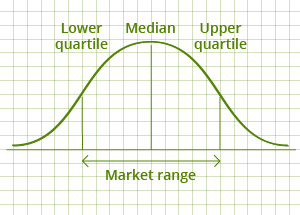

In case that the tax authorities challenged your transfer pricing documentation and conclusions set therein, the following step would be to determine the level of the transfer pricing adjustment. The value of the adjustment imposed by the tax authorities will be determined as the difference between the transfer price included in the taxpayer’s documentation and the value determined by the tax authorities. In cases when the tax authorities are using the transactional net margin method, their value will be determined as median value of the range of net margins shortlisted as the comparable ones.

8. For what transactions must a transfer pricing documentation file be prepared?

As required by the existing laws, a transfer pricing documentation file must be prepared for all company’s transactions with both non-resident related parties and resident related parties, irrespective of the nature and importance thereof. In addition, all transactions carried out with the entity from the jurisdiction of a preferential tax system should be covered by the transfer pricing documentation file.

9. For what period should the transfer pricing documentation file be prepared?

The transfer pricing documentation file should be prepared for the open tax years – the last 5 years. Please note that the obligation to submit the transfer pricing documentation file has only started from FY 2013, the deadline for submission being 180 days after the end of the year.

10. What is the Serbian legal framework for transfer pricing?

The legal framework regulating transfer pricing is the Corporate Income Tax Law (articles 59-62) and Transfer Pricing Rulebook.

11. Who is subject to transfer pricing regulation?

All Serbian resident companies that carry out transactions with related parties are legally bound to prepare transfer pricing documentation files. The term related party is defined in art. 59, par. 2-6 of the Corporate Income Tax Law (Official Gazette RS no. 25/2001, 80/2002, 80/2002, 43/2003, 84/2004, 18/2010, 101/2011, 119/2012 and 47/2013, hereinafter: “CIT Law”).

Generally, most companies being part of a group and carrying out business transactions with other entities of the same group are required to prepare a transfer pricing documentation file. In addition, a Serbian resident company that carries out transaction with a non-resident legal entity established in a jurisdiction with preferential tax system should also prepare transfer pricing documentation files for the transactions concluded with that entity. The list of the preferential tax systems includes 52 countries as per the Rulebook on the list of jurisdictions with a preferential tax system issued by the Ministry of Finance.

12. Are transfer pricing documentation requirements formally imposed for Serbian companies (i.e. requested by law) or “informal” (i.e. recommended)?

Transfer pricing documentation is requested by the CIT Law, i.e. they are formally imposed.

13. In what language should the transfer pricing documentation file be prepared?

Transfer pricing documentation file should be prepared in Serbian.

14. When must a transfer pricing documentation file be submitted?

According to the CIT Law, the transfer pricing documentation file must be submitted together with the annual tax return to the competent tax authorities up to 180 days after the end of the fiscal year. In case the taxpayer omits to submit the transfer pricing documentation file by the given deadline or submits an incomplete documentation, the tax authorities will provide additional 30 up to 90 days to correct the omission.

Also, the tax payer is permitted to submit a short form report (transfer pricing documentation file) for the transactions carried out with associated enterprises under certain values (currently, this threshold is RSD 8 million, approximately EUR 70,000).

Note that according to the law, Serbian resident companies are obliged to submit their yearly financial statements for FY 2013 to the Serbian Business Registers Agency by the latest 28 February 2014. As financial statements also include information regarding the annual income tax to be paid for FY 2013 (which is impacted by the level of transfer pricing adjustments), this implies that any Serbian company that has obligation to comply with the transfer pricing rules should finalize its transfer pricing analysis before 28 February 2014.

15. What are the consequences of failing to prepare the transfer pricing documentation file?

Any failure to submit a transfer pricing documentation file by the end of notice period provided by the tax authorities (30-90 days after 30 June) is subject to a fine ranging between RSD 100,000 and RSD 2,000,000 for the company and additionally RSD 10,000 to RSD 100,000 for the responsible person of the company.

However, the most critical matter is the fact that any failure to submit / submission of an incomplete transfer pricing documentation file entitles tax authorities to proceed to their own assessment of taxpayer’s transfer prices.

Such transfer pricing assessment procedure may result in significant adjustments of the transfer prices applied in related party transactions. Therefore, related parties are advised to prepare their transfer pricing documentation file and avoid facing tax authorities applying their own assessment procedure in disregard of the particularities of the inter-company transactions under review or the tested entity’s functional and risk profiles.

for transfer pricing safety

for transfer pricing safety