How it looks like – see a template

The content of the transfer pricing documentation file

The content of the file generally follows the guidelines included in the Code of Conduct on transfer pricing documentation for associated enterprises in the European Union. The content of the file must be according to the local legislation.

The transfer pricing documentation file should include:

A. Information on the group:

- the organisational, legal and operational structure of the group, including shareholdings, history and financials;

- a general description of the business and business strategy of the group, including changes in the business strategy as compared to the previous tax year;

- a description of and information on the implementation of the transfer pricing methodology within the group, if the case;

- a general description of the transactions between related parties within the EU:

- flows of transactions;

- invoice flows;

- amount of transaction flows;

- a general description of functions performed, risks assumed and a description of changes in functions and risks compared to the previous tax year;

- ownership of intangibles (patents, trademarks, brand names, know-how, etc.) and royalties paid or received;

- a list of advance pricing arrangements entered into by the taxpayer or by other group member companies, except for those issued by the National Agency for Tax Administration.

B. Information on the taxpayer:

- a detailed description of related party transactions:

- flows of transactions;

- invoice flows;

- amount of transaction flows;

- a comparability analysis:

- characteristics of property or services;

- functional analysis (functions performed, risks assumed, fixed assets used etc.);

- contractual terms;

- economic circumstances;

- specific business strategies;

- information on comparable domestic or foreign transactions;

- a list of related parties and permanent establishments involved in such transactions or agreements;

- a description of the transfer pricing method applied and substantiation of the selection criteria;

- a description of other conditions deemed as relevant for the taxpayer.

As a domestic particularity, the order stipulates that benchmarking studies should be firstly carried out at local level and only if no sufficient comparables are found, benchmarking studies can be extended to the regional level.

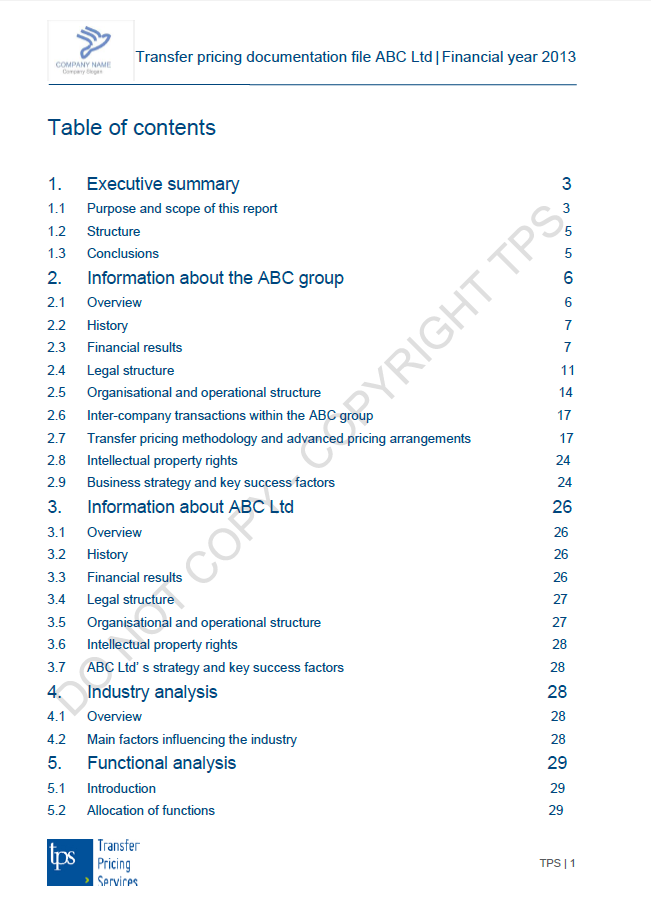

Everyone talks about the transfer pricing documentation file, but not anyone has seen how it looks like. Through our 5 years of experience in transfer pricing, we've prepared this type of report for many clients active in various industries.

Now, TPS shares its know-how with you! For accessing a template of the transfer pricing documentation file just click here.

for transfer pricing safety

for transfer pricing safety