How it looks like – see a template

In order to have a benchmarking study done by the book a few key elements must be considered.

(Note: These steps are not mandatory and any other search process that leads to a set of appropriate comparable companies will be accepted. Therefore, choosing another course of action does not mean that the result does not comply with the arm's length principle.)

Step 1: Determination of years to be covered;

Step 2: Broad-based analysis of the taxpayer’s circumstances;

Step 3: Understanding the transactions under examination, based in particular on a functional analysis, in order to choose the tested party (where needed), the most appropriate transfer pricing method to the circumstances of the case, the financial indicator that will be tested and to identify the significant comparability factors that should be taken into account;

Step 4: Review of existing internal comparables, if any;Step 5: Determination of available sources of information on external comparables where such external comparables are needed taking into account their relative reliability;Step 6: Selection of the most appropriate transfer pricing method and, depending on the method, determination of the relevant financial indicator (e.g. determination of the relevant net profit indicator in case of a transactional net margin method);

Step 7: Identification of potential comparables: determining the key characteristics to be met by any uncontrolled transaction in order to be regarded as potentially comparable, based on the relevant factors identified in Step 3 and in accordance with the comparability factors set forth at paragraphs 1.38-1.63 – OECD guidelines;

Step 8: Determination of and making comparability adjustments where appropriate;

Step 9: Interpretation and use of data collected, determination of the arm’s length remuneration.

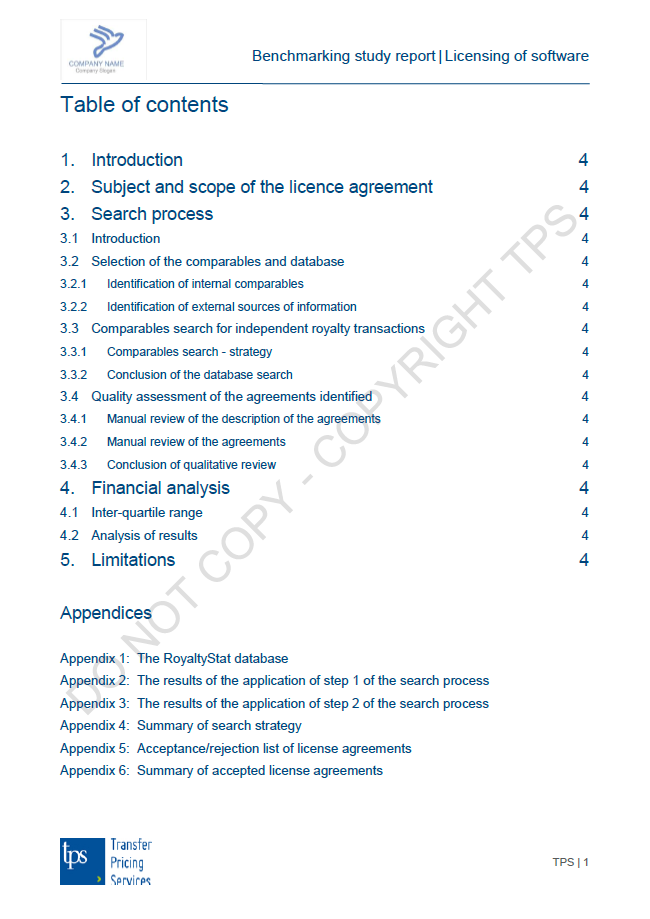

Besides Amadeus / Orbis data bases, which are used to determine profit margins obtained by independent companies, another database which is widely used in practice would be RoyaltyStat used when establishing or testing the market value of the rights of intellectual property royalties licensed between related parties. Given the complexity of such studies, we present below as an example a model of contents that has been successfully tested in practice.

Now, TPS shares its know-how with you! For accessing a template of a benchmarking study just click here.

Nota Bene: A simple copy of the titles will not necessarily gain acceptance of your benchmarking study! The content of the study must be according to the legislation!

for transfer pricing safety

for transfer pricing safety